The AI Race: Halfway Through 2025, How Are We Tracking?

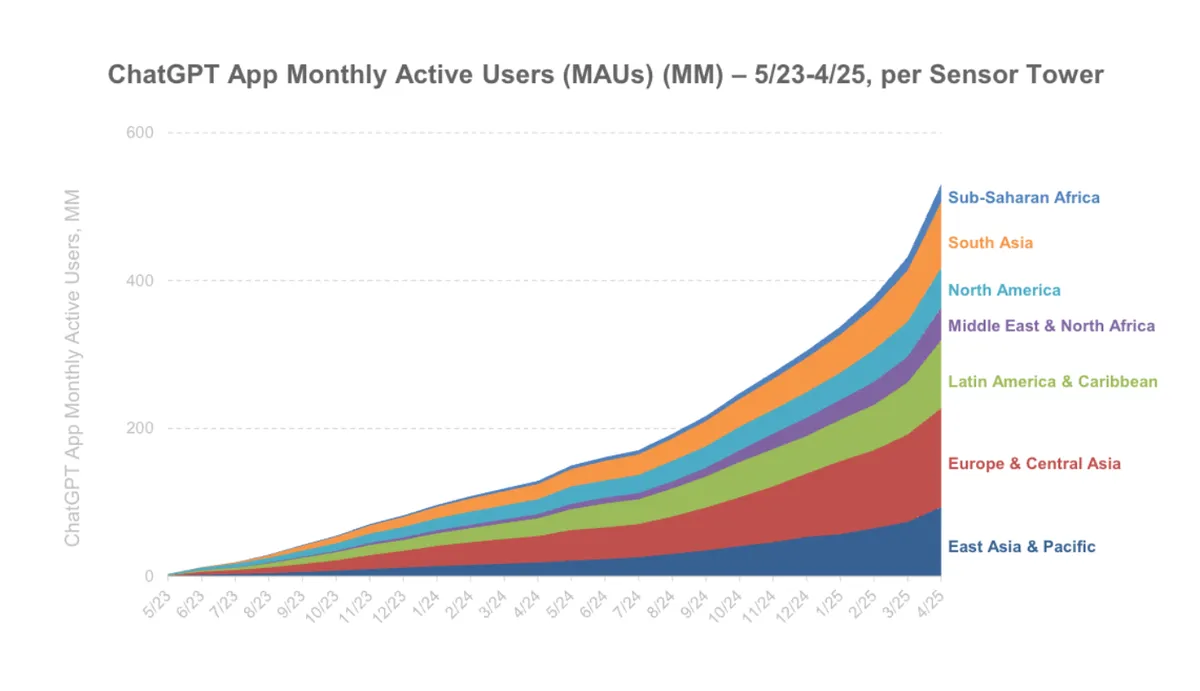

We're halfway through 2025, and the AI revolution is accelerating rapidly — 1 in 5 people globally have now interacted with AI tools like ChatGPT 1. The pace of growth, investment, and technology progress so far this year has been unprecedented.

This post will summarise where the key AI trends are, what the outlook for future innovation looks like, and what that means for those thinking about adopting AI in the near future in Australia.

The TLDR

Although AI technology has been around for a long time, AI is set to be the key trend across Australian companies in the coming decade. Away from the hype, there are a number of clear facts and trends emerging this year:

The pace of AI technology innovation continues to accelerate, with the innovation across the first half of 2025 outpacing the last half of 2024. The second half of 2025 looks likely to continue this trend, with a major emphasis on coding and agentic systems by the frontier labs

AI is now mainstream. 1 in 5 people across the world have used a GPT. ChatGPT grew from 400 to 800 million monthly active users from January to April this year. Google grew to ~400 million monthly average users2. The pace of adoption by consumers has been unprecedented

Enterprises remain at an early stage of adoption. Advances in interoperability and reduction in pricing for more powerful models along with improved / easy access to methods like reinforcement learning, mean many enterprise use cases are now feasible

A significant gap persists between the underlying capabilities of AI and their translation into products across both B2C and B2B market places. There are numerous opportunities for those who 'box smart' and understand where the technology is today and where it will be in the next six months. There is a major wealth creation moment occurring across early adopters.

Despite the hype, there are also risks. The market is still maturing for enterprise. Risks include vendor lock-in, data security, regulatory uncertainty, and potential talent shortages.

In Australia, 40% of enterprises are set to pause, slow down, or stop AI projects in the coming year, due to an inability to derive value from their investments3. The value is clearly there, but the wrong choices (whether strategy, approach, talent) can scupper benefits.

Looking forward:

Is the hype of AGI / ASI real? Hard to say. AGI, is not a well defined term yet. If we take the most consensus driven definitions for AGI, it seems probable (subject to key research breakthroughs) in a short-medium time scale (e.g. 1-4 years). ASI - the hype has started but this seems much less clear.

For people and companies in Australia - AI offers everyone major value, and allowing for the likely future innovation that is coming, AI could transform for some companies how they generate value, and for many people - where / what they do for work.

Let's dive in to the data.

What’s happened so far?

With so much going on, let's use a simple framework, to help understand where innovation is occurring across the AI value chain.

AI Layer Cake - Breaking down the changes in 2025

Let's build up from the bottom of this diagram - starting with compute.

1. Compute: GPUs are the New Oil

Nvidia’s shares are through the roof, trading at around USD$157.

Nvidia traded at USD$31 in June 2023.

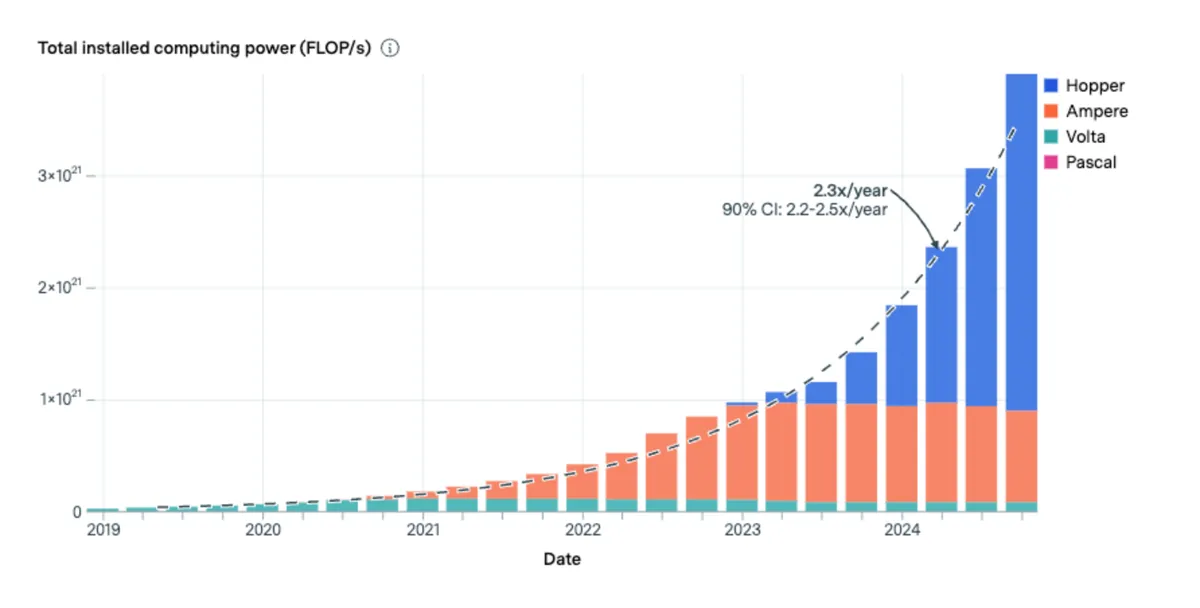

Models require a large amount of compute - for pre-training, and inference (compute required at run time). AI demand has kicked off a GPU shortage. To meet this demand, installed compute for Nvidia chips has doubled each year.

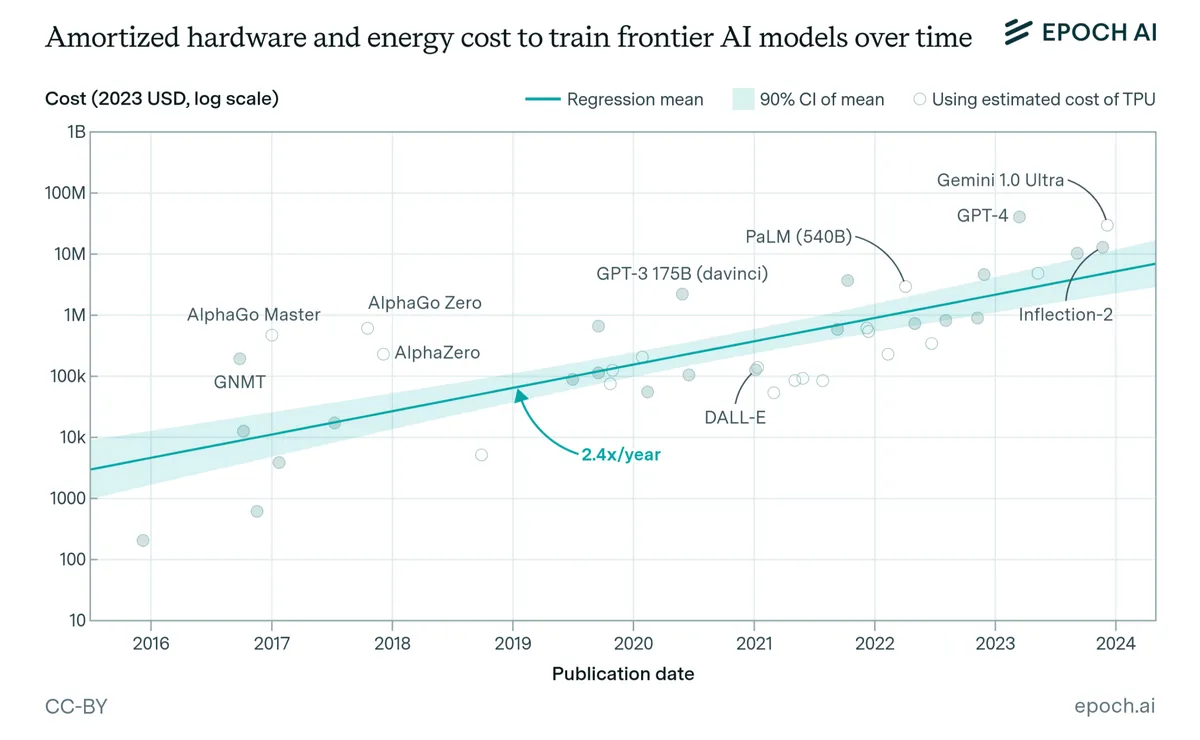

Epoch.ai - June 2025

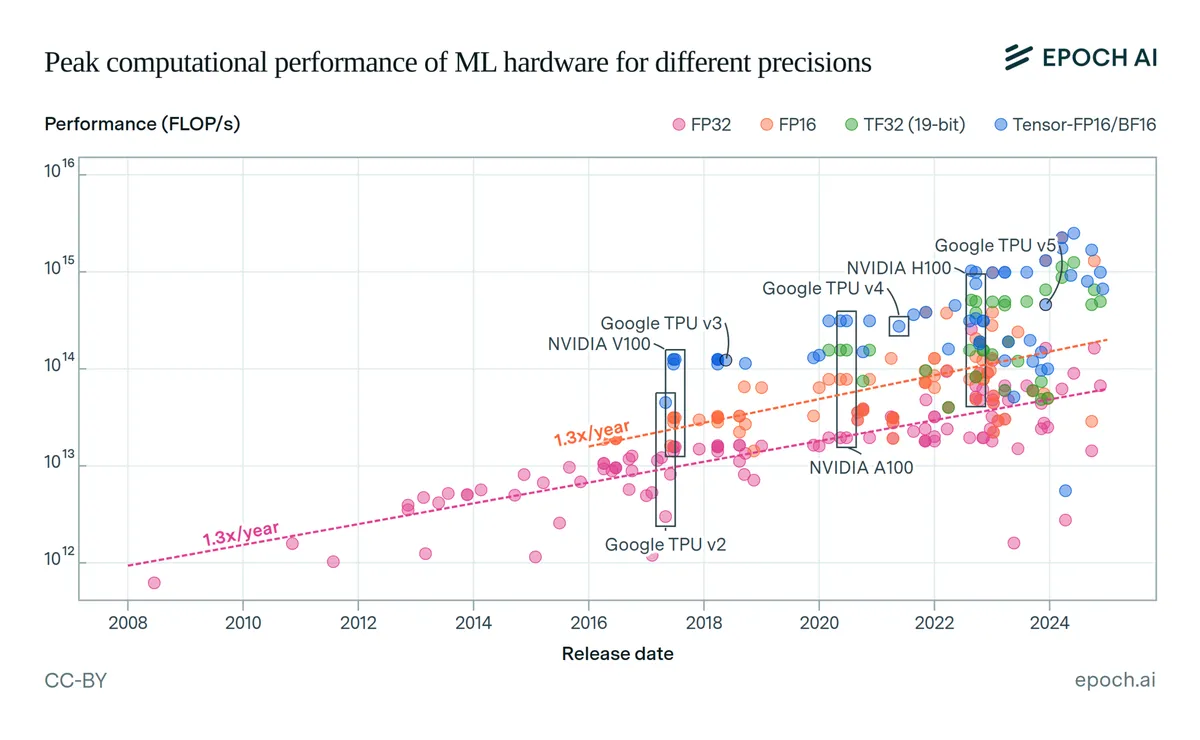

Compounding these gains, the computational performance of machine learning hardware is doubling every 2 years.

Epoch.ai - June 2025

Meanwhile, data centres are becoming mega-projects. The "Stargate" initiative, as one example is a $500 billion effort to scale up supercomputing in the US. These projects are becoming the new norm. AWS, Google, Oracle are investing in new chip architectures and data centres to support a major increase in demand from model labs, startups and SaaS companies needing GPU compute. This trend does not look set to slow down, given how early we are in the product lifecycle for AI (see below).

The implication for this is that model capabilities will improve - both in terms of how frontier labs will be able to train the next generation of models, but also the availability of compute for inference.

How this demand for data centres plays out with local communities across the world, financiers interested in the long term value of these fleets, and with governments / utilities trying to plan for the long term health of the electricity grid remains to be seen. As Mary Meeker bluntly put it, "the compute race is the new oil race," and everyone’s in it for the long haul.

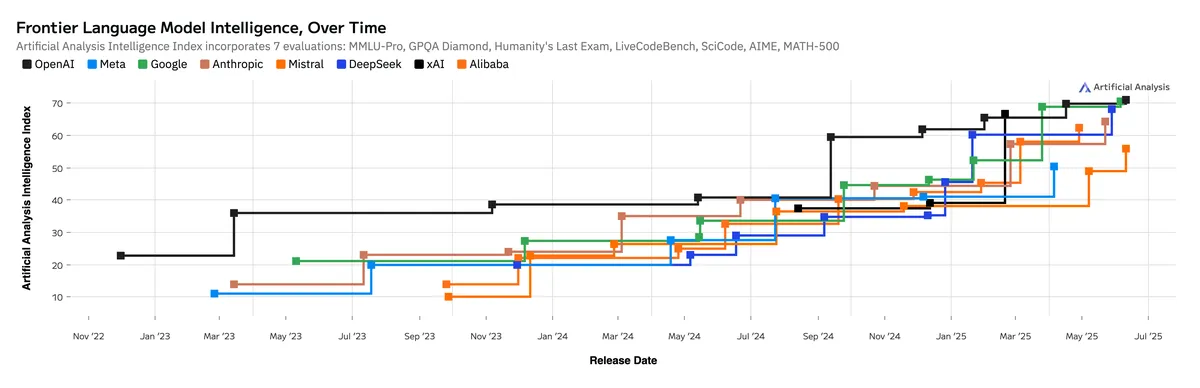

2. AI Development: Frontier Models – The Race is Global, and Getting Competitive

AI's headline acts, the frontier models, have come a long way. Both reasoning models and non-reasoning models have improved significantly this year. Some examples:

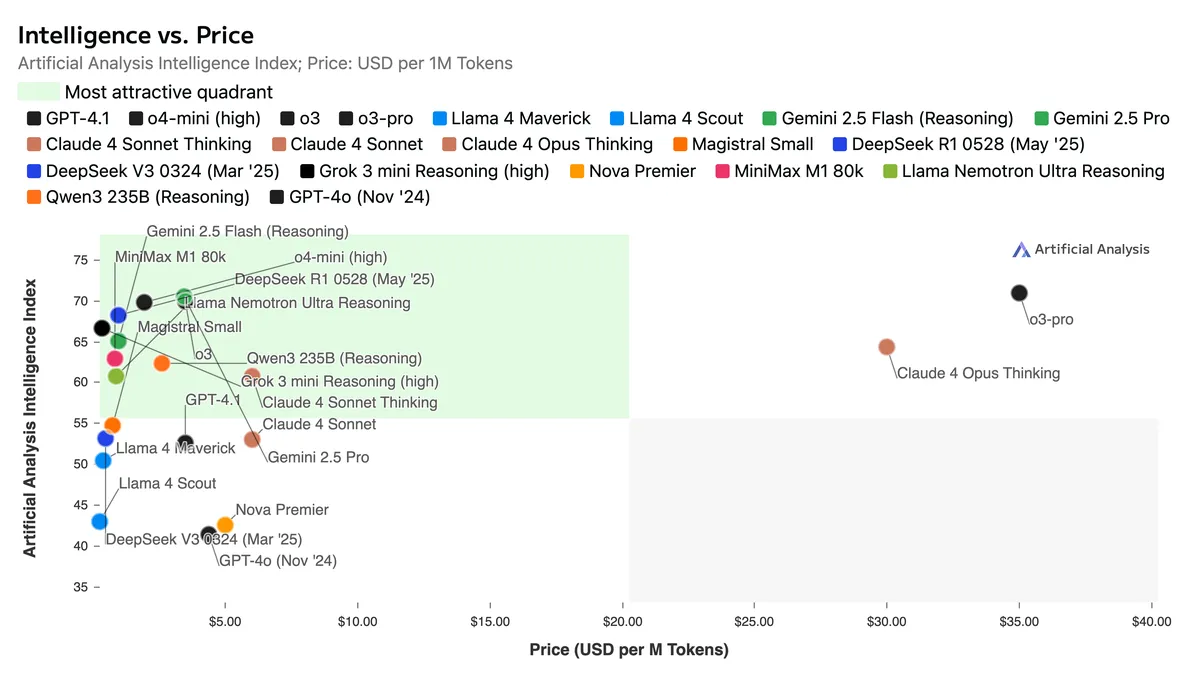

- Reasoning Models: From OpenAI - we have gone from 01-pro, to o3 to o3-pro in just a few months, with the cost of of o3 coming down 10x and is cheaper to run than many non-reasoning models (including ChatGPT 4o). Google has launched Gemini 2.5 pro which leads on most benchmarks, while Anthropic has launched Claude 4 Sonnet and Claude 4 Opus, which demonstrate particularly good coding and reasoning capabilities. Deepseek R1, the Chinese lab, has also received a major update.

While intelligence capabilities have shot up this half, the cost of that intelligence has come down.

Artificial Analysis - June, 2025

Artificial Analysis - June, 2025

Artificial Analysis - June, 2025

- Non-Reasoning & Multi-modal: The workhorse non-reasoning models have continued to proliferate. There are a plethora of closed and opensource variants. Of particular interest is the increasing number of capable models which can work on device - whether laptop or mobile (e.g. Google's Gemma 3 and Gemma 3n series). ChatGPT 4o remains a dominant multimodal model capable of voice to text, text to voice, text to image with search, deep research and other tools available to support a wide range of use cases.

- The big push has been into coding - with a big focus on coding specific models. Codex-1, Windsurf's SWE-1, and the aforementioned Google Gemine 2.5 pro, Claude 4 Sonnet / Opus, are all delivering much greater coding performance. Whilst these models can work often work well on established code-bases on standard patterns, there are still limitations and the models are early stage.

- Chinese outfits like Alibaba’s Qwen-2.5 and ByteDance’s CodeFuse have burst onto the scene, matching or even beating Western labs on key tests. Despite global interventions on the supply of Nvidia GPUs to the region, there is a major push by Chinese firms to prove that smart algorithmic and engineering innovation can stay close to the raw horsepower of training major models.

More broadly, model training runs, which are a major lever to increasing model intelligence, as we look forward into the second half of the year will continue to get bigger. OpenAI's Abilene data centre (one of the largest in the world) comes online later this year. The cost of frontier models will cross USD$1bn at some point in the future.

Epoch.ai - June 2025

Looking at the academic and research angle - it's clear that the pace of research continues to grow. Multiple papers in the first half of this year offer major potential progress - across a range of topics including:

- Memory (AI systems that will remember more and more about the individuals and workspace they work in)

- Recursive learning (enabling AI to self-learn and improve)

- Major efficiency breakthroughs (e.g. inference, lower latency, memory efficiency)

- Longer context windows

- Interpretability research

- New architectures

With so much money at play across both proprietary and opensource labs - there appears many levers still to ensure model capabilities grow for some time.

3. Integration and Interoperability - enabling AI to work with regular systems

While consumer applications have exploded in popularity - these at the turn of the year were mostly still a basic chatbot experience. This year, we have seen a range of new industry protocols / standards which are accelerating how we integrate AI systems into standard systems. Examples include Anthropic's open source initiative - Model Context Protocol (MCP), Google's Agent to Agent (A2A) framework. Both of these offer ways for LLMs to integrate with standard systems. MCP's have particularly grown in popularity with over 3000 already developed since the start of the year 4. These allow any LLM to connect to any system which has exposed it's services as an MCP client. This enables a language model to work with core systems to initiate payments, work with stock data, integrate with company project management tools etc. The opportunities are endless. That said - we are still at the early stages of making these new integrations safe and secure, with the standards improving month on month to accommodate this.

Interoperability is going to be a major theme for start-ups and enterprise to realise value, and the initial tracks are being laid.

4. Products & Applications

The last 6 months has been dominated by innovations across the following:

- Frontier Labs (Anthropic, Openai - ChatGPT, Google)

ChatGPT is now at ~800 million users per month as of June 2025, and has heavily invested in both it's API offerings and it's user experience - deftly managing both consumer, enteprise, SME business needs through it's ChatGPT offering. In addition to new models - there's new voice, meeting recording, connections to internal systems, and writing / editing capabilities.

Mary Meeker, Bond Capital - Trends Artificial Intelligence, May 2025, data based off April 2025)

Google and Anthropic are growing rapidly, and equally investing in consumer and enterprise tooling. Google / Azure / AWS are investing heavily, as hyperscalers, in the developer layer (e.g. Google AI Studio / Vertex, Azure AI Services, Amazon Bedrock) to enable organisations to build agentic systems, with access to many models. All hyperscalers are invested in their own chip alternatives, given the high prices / demand surge for Nvidia GPUs.

Agentic Systems:

AI-driven systems that are capable of autonomously executing tasks,

making decisions, and interacting dynamically with other

systems or environments without continuous human

direction.

Cursor and Windsurf emerged in 2023 with new Integrated Developer Environments that could rapidly accelerate software development, which were heavily integrated to the frontier labs' models. The product progress across both these companies has been rapid.

The frontier labs are also betting big on software development, and have responded with offerings of their own - both in the developer terminal, and through new agentic experiences through new apps - e.g. terminal experiences like Claude Code CLI, Google Gemini CLI, and OpenAI Codex CLI; versus agentic experiences such as Google Jules, OpenAI Codex, Factory AI).

OpenAI has also allegedly acquired Windsurf for USD$3bn.

Clearly, coding is the major battleground, and many of the frontier labs are forecasting major improvements in their model capabilities by the end of the year. This domain, not only is a big market, but achieving greater coding accuracy will also create downstream benefits to rolling out Agentic AI experiences across other domains.

The benefits to startups and enterprise, just from AI-supported software development would be major in Australia.

- SaaS & Enterprise

Beyond the frontier lab companies - we have seen AI embedded heavily in existing SaaS products - from Salesforce (via Agentforce) to Notion, with new / improved enterprise tooling emerging to help enterprises build agentic experiences (e.g. n8n, workato etc).

However, the key to enteprise implementation is blending a knowledge of this new emerging technology, with a deep understanding of the companies business problem / needs and expertise of the business domain. There has been mixed results on this front, with Gartner forecasting that 40% of AI projects in Australia may be paused / halted, as companies get to grips with how best to implement the technology.

Gartner - June 2025

Gartner - June 2025

Voice agents look to be a major trend going into the second half of the year. Companies like elevenlabs have made major progress with speech to text, text to voice, multi-modal agents that connect to company tools. There are major opportunities for new voice experiences in consumer apps, in addition to contact centres adopting this technology to improve customer experience and drive efficiencies.

Video - consumer and enterprise applications for video have grown at a rapid rate. From Google's Veo 3 to Midjourney to Kling AI to Runway. These tools are making short, realistic videos, now with sound / voice. While still nascent, the potential for these models to disrupt marketing / branding and potentially film more broadly are clear watch points.

However, it could be said that the product development rate is not keeping pace with the underlying innovation, which is understandable given how rapid the initial progress has been.

I'd argue there is a major product overhang emerging between the capabilities of the models, the ability to now integrate them to regular systems, versus the pace of new product development and enterprise implementation. The potential for brand new experiences, transformed procesess / operations in enterprise is now possible. This is before we anticipate further model improvements / interoperability improvements over the rest of this year.

The outlook for the second half of 2025?

These trends lead to an assumption that the pace of change will continue to pick up into the second half of 2025. Innovation is occurring everywhere - new chips, bigger data centers, bigger training runs, reducing cost of compute, new voice and video capabilities, better interoperability across AI and traditional systems, smaller more capable models that live on the edge, and the growth of new products for consumers and business.

Australian enterprises stand at a critical juncture. There is enormous potential for businesses to reshape customer and employee experiences, and unlock major value. However, the path forward requires strategic foresight. Choosing the right technologies, cultivating specialised talent, and balancing ambition with pragmatic execution will be key.

Despite an uncertain global economic client, there's potential for organisations to not only thrive but to reshape industries, forging substantial value creation for years to come.

As we move to the second half of the year - it will be interesting to see whether the exponential growth rates we have seen to date across so many areas continues.